Engineered Services, Inc. is proud to offer a comprehensive benefits package to eligible, full-time employees who work 30 hours per week. The complete benefits package is briefly summarized in this booklet. You will receive plan booklets, which give you more detailed information about each of these programs.

You share the costs of some of the (medical, dental and vision) benefits, and Engineered Services, Inc. provides other benefits at no cost to you (life, accidental death & dismemberment). In addition, there are voluntary benefits with reasonable group rates that you can purchase through payroll deductions.

Benefits Offered

- Medical

- Dental

- Vision

- Flexible Spending Account (FSA)

- Life Insurance

- Accidental Death & Dismemberment (AD&D) Insurance

- Voluntary Life and AD&D

- Voluntary Short Term Disability

- Long Term Disability

Eligibility

You and your dependents are eligible for Engineered Services, Inc. benefits on 90 days of employment.

Eligible dependents are your spouse, children under age 26, disabled dependents of any age, or Engineered Services, Inc. eligible dependents.

Elections made now will remain until the next open enrollment unless you or your family members experience a qualifying event. If you experience a qualifying event, you must contact HR within 30 days. * See Life Events Tab for more information*

Medical

Aetna

Policy: 0234356

Phone Number: 800.872.3862

Comprehensive and preventive healthcare coverage is important in protecting you and your family from the financial risks of unexpected illness and injury. A little prevention usually goes a long way— especially in healthcare. Routine exams and regular preventive care provide an inexpensive review of your health. Small problems can potentially develop into large expenses. By identifying the problems early, often they can be treated at little cost.

Comprehensive healthcare also provides peace of mind. In case of an illness or injury, you and your family are covered with an excellent medical plan through Engineered Services, Inc.

Engineered Services, Inc. offers you one (1) in area and one (1) out of area HSA medical plans. Click on each of the plan options for more information.

In DC, MD, VA Benefit Plan Option; AFA CPOSII 2750 HSA

Out of DC, MD, VA Benefit Plan Option: IHFA Open POSII 2750 HSA

The plans uses the Aetna network and covers 100% of the cost for preventive care services like calendar year physicals and routine immunizations. The way you pay for care is different with each plan.

With the HDHP, you pay the full negotiated cost for medical services and prescription drugs until you meet your calendar year deductible. If you meet the deductible, you and the plan share the costs (coinsurance) until you reach the calendar year out-of-pocket maximum. After that, the plan pays for 100% of your claims for the rest of the year.

Health Fund One to One HSA Flyer

Your employer will contribute $1,800 to your Health Savings Account for the 2023/24 plan year

The maximum contribution from all combined sources for 2023 calendar year is:

$3,850 Single; $7,750 Family (Employee plus 1 or more dependents)

For HSA Questiosns:

You can visit payflexwallet.com or

call us at 1-855-384-8249 (TTY:711). We’re

here to help Monday – Friday, 8 a.m. – 8 p.m. ET.

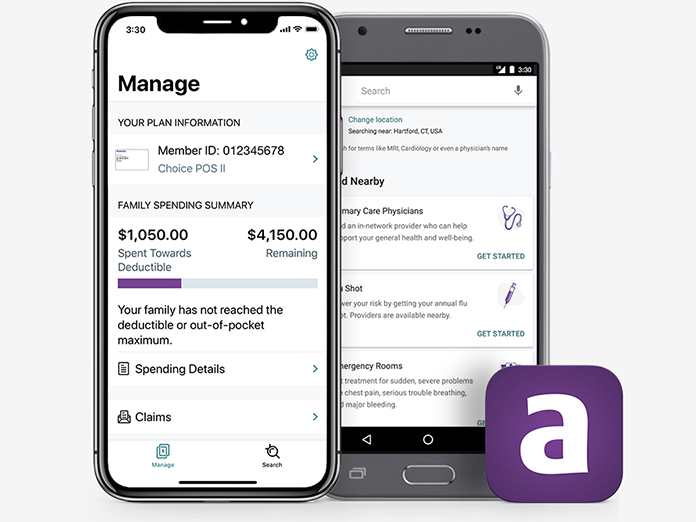

The Aetna HealthSM app: an easier way to manage your health benefits

Manage your benefits on the go--right from your phone--with the Aetna Health app. You can find doctors, compare costs, view claims, track spending and more. It’s a smarter, simpler, and more convenient way to take charge of your health care and benefits.

Dental

Aetna

Policy: 0234355

Phone Number: 800.872.3862

Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with the Engineered Services, Inc. dental benefit plan.

You can review your Dental Benefits Here.

Flexible Spending Accounts

TASC - Total Administrative Services Corporation

Phone Number: 608.241.1900

You can save money on your healthcare and/or dependent day care expenses with an FSA. You set aside funds each pay period on a pretax basis and use them tax-free for qualified expenses. You pay no federal income or Social Security taxes on your contributions to an FSA. (That’s where the savings comes in.) Your FSA contributions are deducted from your paycheck before taxes are withheld, so you save on income taxes and have more disposable income.

For 2023:

Healthcare Spending Limit $3,050

Dependent Care Spending Limit $5,000

Health Care FSA

- Full annual election amount is available day 1 of your plan year!

- Only permitted to change election amount if you have a change in status (i.e., marriage, birth of a child).

Use or Lose Rule - unused funds do not rollover! There is a 2.5 month grace period at the end of the plan year during which you can incur claims.

Dependent Care FSA

- Pay-as-you-go” account

- Can change election only if you have a change in status or change in dependent care expenses.

- Use or Lose Rule - unused funds do not rollover! There is a 2.5 month grace period at the end of the plan year during which you can incur claims.

- $5,000 household annual maximum contribution per year; $2,500 if married and filing a separate return.

PLEASE NOTE: There is a 90 day run-out period at the end of the plan year (or grace period for DC FSA) that allows you to request reimbursement for claims incurred during the plan year or grace period.

Dependent Care Eligible Expenses

Note: FSA is a January renewal and NOT in open enrollment.

Vision

Mutual of Omaha

Policy: G000CDNX

Phone Number: 800.775.6000

Regular eye examinations can not only determine your need for corrective eyewear but also may detect general health problems in the earliest stages. Protection for the eyes should be a major concern to everyone.

Review Your Vision Plan Summary

Life/AD&D

Mutual of Omaha

Policy: 070523

Phone Number: 800.775.6000

Life Insurance

Life insurance provides financial security for the people who depend on you. Your beneficiaries will receive a lump sum payment if you die while employed by Engineered Services, Inc. The company provides basic life insurance of 2x annual salary up to $300,000 at no cost to you if you participate in the medical plans offered by Engineered Services, Inc.

Accidental Death and Dismemberment (AD&D) Insurance

Accidental Death and Dismemberment (AD&D) insurance provides payment to you or your beneficiaries if you lose a limb or die in an accident. Engineered Services, Inc. provides AD&D coverage of 2x annual salary up to $300,000 at no cost to you. This coverage is in addition to your company-paid life insurance described above if you participate in the medical plans offered by Engineered Services, Inc.

Review Your Life/AD&D Plan Summary

Voluntary Life and AD&D

You may purchase life and AD&D insurance in addition to the company-provided coverage. You may also purchase life and AD&D insurance for your dependents if you purchase additional coverage for yourself. You are guaranteed coverage (5x annual salary, up to $30,000* for you,100% of Employee's Benefit, up to $15,000 for your spouse and

$10,000 for your children) without answering medical questions if you enroll when you are first eligible.

Employee— Increments of $10,000; 5X Annual Salary, up to $500,000 maximum amount Spouse**— Increments of $5,000; up to $250,000 (100% of Employee's Benefit) Children— Increments of $2,000; up to $10,000

Review Your Voluntary Life/AD&D Plan Summary

Voluntary Short Term Disability & Long Term Disability

Mutual of Omaha

Policy: 070523

Phone Number: 800.775.6000

Engineered Services, Inc. also provides disability insurance through Mutual of Omaha. This benefit replaces a portion of your income if you become disabled and are unable to work.

Short Term Disability is Voluntary, and 100% Employee paid.

Long Term Disability is Employer paid for all Eligible Employees.

Review Your Voluntary Short Term Disability Plan Summary

Review Your Long Term Disability Plan Summary (All Other Employees)

Review Your Accessing Claims Online Flyer

Will Preparation, Travel Assistance, EAP & Hearing Discounts

Mutual of Omaha

Phone Number: 800.775.6000

Review Your Will Preparation Plan Summary

Creating a will is an important investment in your future. It specifies how you want your possessions to be distributed after you die.

Whether you’re single, married, have children or are a grandparent, your will should be tailored for your life situation.

Here’s how it works:

- Log on to willprepservices.com and use the code MUTUALWILLS to register

- Answer the simple questions and watch the customization of your document happen in real time

- Download, print and share any document instantly

- Don’t forget to update your documents with any major life changes, including marriage, divorce, and birth of a child

- Make the document legally binding — Check with your state for requirements.

Review Your Employee Assistance Program Plan Summary

Life isn’t always easy. Sometimes a personal or professional issue can affect your work, health and general well-being. During these tough times, it’s important to have someone to talk with to let you know you’re not alone

We are here for you

Visit the Employee Assistance Program website to view timely articles and resources on a variety of financial, well-being, behavioral and mental health topics

or

call at 800.316.2796

Review Your Travel Assistance Plan Summary

Travel Assistance Travels With You

Experiencing an emergency while traveling can be especially difficult. Knowing who to call for medical problems, currency exchange issues or lost luggage is critical. Take comfort in knowing that Travel Assistance travels with you worldwide, offering access to a network of professionals who can help you with local medical referrals or provide other emergency

assistance services in foreign locations.

Assistance with:

ID Theft

Education and Prevention

Recovery Information

Pre-Trip Assistance

Immediate Assistance with Emergency when Traveling

Medical Assistance

Worldwide Travel and ID Theft Assistance

Services available for business and personal travel 24 hours a day, seven days a week.

For inquiries within the U.S. call toll free: 1-800-856-9947

Outside the U.S. call collect: (312) 935-365

Review your Hearing Discount Program

Program Benefits - In addition to your hearing care benefit, you will have access to complimentary aftercare*, including:

Custom hearing solutions — wide choice of products from the industry’s leading brands

Risk-free trial — find your right fit by trying your hearing aids for 60 days

Follow-up care — ensures a smooth transition to your new hearing aids

Battery support — battery supply or charging station to keep your hearing aids powered

Warranty — 3-year coverage for loss, repairs, or damage

Financing — no interest for those who qualify

Savings for family and friends — your parents, siblings, in-laws, and friends qualify, too

To learn more visit: amplifonusa.com/mutualofomaha